Asia’s Markets Roar Back After a Dip: A Tale of Two Weeks

The Asian stock markets experienced a dramatic turnaround this week, bouncing back strongly from recent losses. This surge follows a positive close on Wall Street the previous week, setting a hopeful tone for the region. The rebound is particularly noticeable in China, where a robust Purchasing Managers’ Index (PMI) fueled significant gains. The PMI, a key indicator of manufacturing activity, signaled a healthier-than-expected performance, injecting confidence into investors.

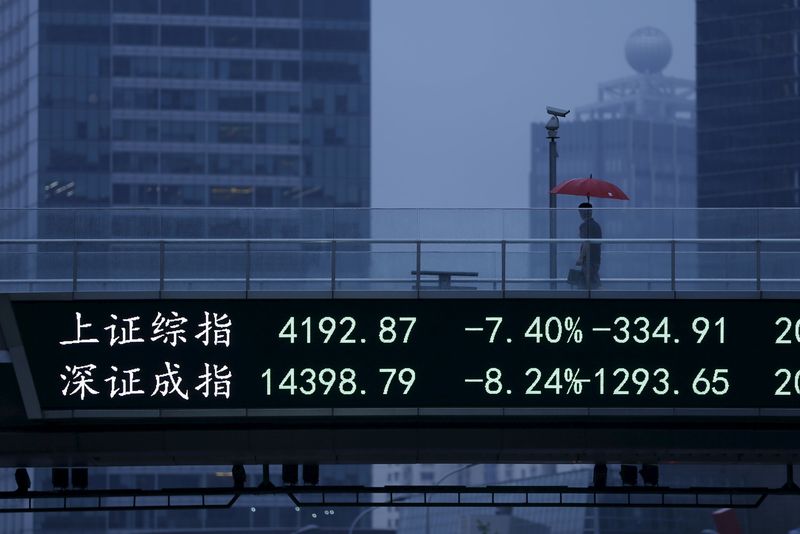

This week’s positive performance represents a significant shift in sentiment compared to the preceding period. While the specifics of the previous downturn aren’t explicitly detailed, it’s clear that investor anxiety played a significant role. Market volatility is a familiar characteristic of the financial landscape, often driven by a complex interplay of global events, economic data, and investor psychology. This recent upswing, therefore, serves as a reminder of the cyclical nature of market behavior and the potential for sudden shifts in momentum.

The strong PMI data from China is a crucial catalyst behind the current market optimism. China, being a global economic powerhouse, carries substantial weight in the overall performance of Asian markets. A strong PMI suggests increased industrial production, higher demand, and a generally healthy economic outlook for the nation. This positive news filters into investor confidence, driving capital inflow and pushing stock prices upward.

However, it’s crucial to view this resurgence with a degree of caution. While the current gains are encouraging, they don’t necessarily signal a complete reversal of any underlying concerns. The markets are inherently complex, influenced by various factors beyond simple economic indicators. Geopolitical tensions, regulatory changes, and unexpected economic events can all contribute to market fluctuations. Therefore, the current optimism needs to be tempered with awareness of potential future risks.

The rebound in Asian markets is not solely attributable to the Chinese PMI. The positive close on Wall Street in the preceding week provided a crucial boost in confidence. Global market interconnectedness is a defining characteristic of the modern financial system. Positive trends in one major market often spill over into others, creating a ripple effect across the globe. The strong performance in the United States, therefore, acted as a catalyst, reinforcing the positive momentum already building in Asia due to the strong PMI figures.

Several factors likely contributed to the cautious optimism seen among investors. While the immediate positive news is encouraging, the long-term outlook often remains a subject of debate and analysis. Investors are likely carefully assessing the sustainability of the current gains, evaluating the underlying economic fundamentals and considering potential future headwinds. This cautious approach reflects a mature and responsible investment strategy, emphasizing the importance of long-term planning and risk mitigation.

In conclusion, the recent rebound in Asian markets, particularly the surge in China driven by a strong PMI, offers a welcome respite from recent uncertainty. However, investors should maintain a balanced perspective, acknowledging the cyclical nature of the market and remaining aware of the potential for future volatility. The current gains represent a positive development, but sustained growth depends on the ongoing strength of economic fundamentals, both domestically within Asia and globally. The close relationship between global markets underscores the need for a holistic view, considering the interplay of international events and economic data in shaping market trends.

Leave a Reply