Asian Markets Soar After Recent Dip: A Resurgence Fueled by Positive Data

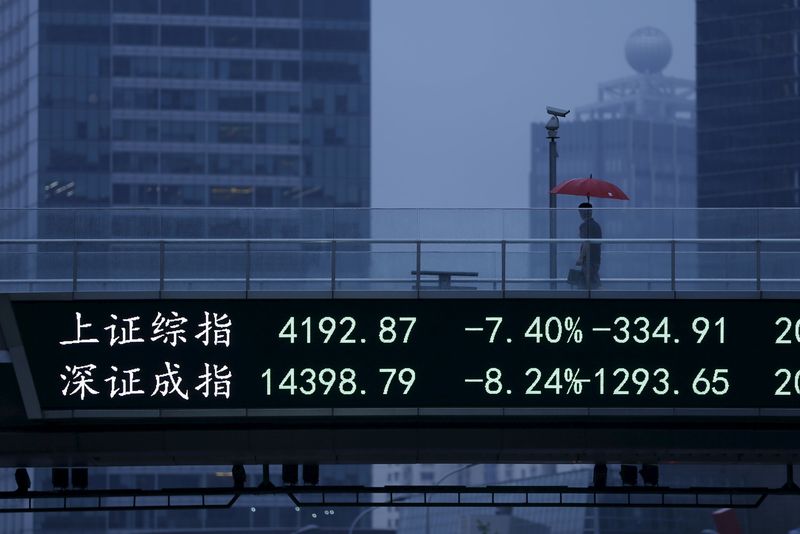

After a period of significant downturn, Asian stock markets experienced a robust rebound at the beginning of the month. This surge followed a strong close on Wall Street the previous week, setting a positive tone for the Asian trading sessions. The resurgence wasn’t uniform across the board, however, with Chinese markets leading the charge thanks to encouraging economic indicators.

The primary catalyst for this positive shift in sentiment appears to be a surprisingly strong Purchasing Managers’ Index (PMI) for China’s manufacturing sector. The PMI, a key gauge of economic health, indicated robust factory activity, exceeding expectations and signaling a healthy level of production and demand. This positive data injected a much-needed dose of confidence into investor circles, prompting a significant influx of buying pressure in Chinese equities. The strength of the PMI data suggests a resilient Chinese economy despite ongoing global uncertainties, reassuring investors who had previously expressed concerns about slowing growth.

Beyond China, the broader Asian market recovery can be attributed to several interconnected factors. The positive momentum from Wall Street’s previous week provided a crucial psychological boost, influencing investor decisions and creating a more optimistic outlook. This spillover effect from the US markets is a common phenomenon, highlighting the interconnected nature of global finance. Investors, seemingly emboldened by the strong US performance, appeared more willing to take on risk in the Asian markets.

However, despite the significant gains, it’s crucial to acknowledge the cautious optimism prevailing among investors. The rebound, while welcome, should not be interpreted as a complete reversal of the previous downturn. Many remain hesitant about the long-term trajectory of the global economy, citing factors such as persistent inflation, rising interest rates, and geopolitical instability. This cautious sentiment is reflected in the measured nature of the market recovery, preventing a full-fledged rally.

Specific sectors within the Asian markets also exhibited varying degrees of recovery. While technology stocks, often sensitive to shifts in investor sentiment, participated in the upward trend, some other sectors remained more subdued. This suggests that the market’s recovery isn’t entirely uniform, and underlying economic conditions continue to impact different sectors differently.

Looking ahead, the sustained strength of the recovery will depend on several key factors. Continued positive economic data from China, particularly in relation to consumer spending and overall economic growth, will play a vital role. Furthermore, the performance of other major global economies will also significantly influence investor confidence in Asian markets. Any renewed concerns about inflation or geopolitical tensions could quickly reverse the current positive trend.

In conclusion, the recent surge in Asian stock markets marks a significant positive development, fueled by strong PMI data from China and positive spillover from Wall Street. However, underlying uncertainties remain, and investors are maintaining a cautious approach. The sustainability of this recovery hinges on several ongoing economic and geopolitical factors, underscoring the need for continued monitoring and analysis of market trends. The coming weeks will be crucial in determining whether this rebound represents a sustainable shift or a temporary reprieve in the face of ongoing global challenges.

Leave a Reply