A Surge in Asian Markets: A Cautious Optimism

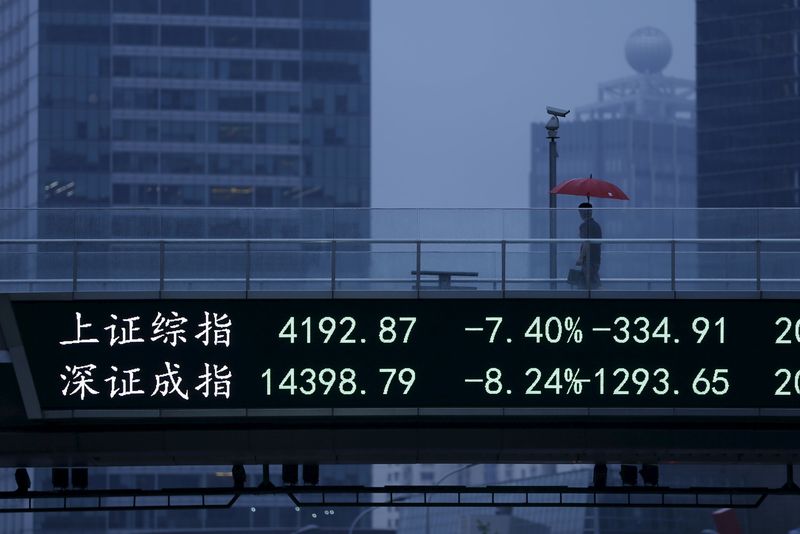

Asian markets experienced a significant rebound at the beginning of the month, reversing recent steep losses and signaling a potential shift in investor sentiment. This upward swing follows a strong performance on Wall Street the previous week, suggesting a degree of global market interconnectedness and a shared response to positive economic indicators. The surge is particularly notable in China, where shares experienced a considerable gain fueled by robust factory activity data.

This positive PMI (Purchasing Managers’ Index) reading indicates a healthy expansion in China’s manufacturing sector. The PMI, a key economic indicator, reflects the prevailing sentiment among purchasing managers in factories and offers valuable insight into the current state of the manufacturing economy. A strong PMI suggests increased production, higher demand, and a generally positive outlook for the sector. This positive data point alleviated concerns about a potential slowdown in the Chinese economy, a significant factor influencing global markets given China’s role as a major economic player.

However, while the market surge is undeniably positive, analysts and investors are urging caution. The rebound shouldn’t be interpreted as a complete reversal of the recent negative trends. The underlying economic uncertainties remain, and a sustained recovery will depend on several factors.

Geopolitical instability continues to cast a shadow over the global economic landscape. International tensions and ongoing conflicts contribute to market volatility and uncertainty, making it challenging for investors to make long-term projections with confidence.

Inflation, another major global concern, remains a significant challenge. Although inflation rates may be showing signs of moderation in some regions, the persistent pressure on prices continues to impact consumer spending and corporate profits. Central banks are carefully navigating the delicate balance between combating inflation and avoiding a recession, a situation that further contributes to market uncertainty.

Furthermore, the rise in interest rates by many central banks globally impacts investor behaviour. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings. This makes investors more selective about where they allocate their capital, leading to potential shifts in market valuations.

The rebound in Asian markets, therefore, is a complex event reflecting a combination of positive data, global market influences, and persistent underlying economic challenges. The strong PMI data from China provided a much-needed boost, but the future remains subject to several unpredictable factors.

Investors are advised to maintain a cautiously optimistic approach. While the recent market surge offers a glimmer of hope, a sustained recovery requires a confluence of positive factors, including further improvements in economic indicators, resolution of geopolitical uncertainties, and a manageable trajectory for inflation. The market’s trajectory in the coming weeks and months will hinge on these developments. A thorough analysis of these variables is essential for investors to make informed decisions and effectively navigate the complexities of the global market. Short-term gains should be viewed within the context of long-term economic and geopolitical prospects.

Leave a Reply