Asian markets surge after a period of decline, fueled by positive economic indicators and a ripple effect from Wall Street’s strong performance. The recovery signals a potential shift in investor sentiment, offering a glimmer of hope after recent volatility.

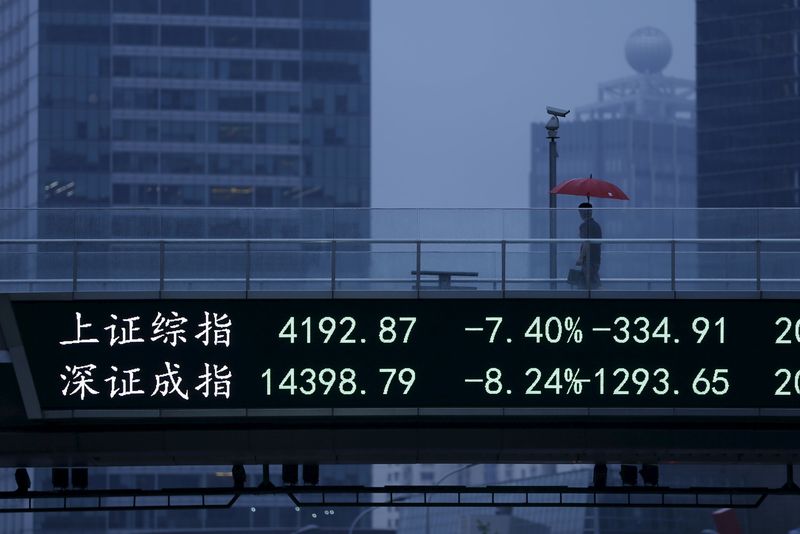

This dramatic turnaround is primarily attributed to a surprisingly robust Purchasing Managers’ Index (PMI) for China’s manufacturing sector. The PMI, a key gauge of factory activity, exceeded expectations, suggesting a healthier-than-anticipated industrial output. This positive data injected a much-needed dose of optimism into the market, particularly impacting Chinese equities which experienced significant gains. The strength of the manufacturing sector indicates a more resilient Chinese economy, potentially signaling continued growth despite global uncertainties. This positive news calmed investor anxieties surrounding the world’s second-largest economy and its impact on global trade.

The rebound in Asian markets wasn’t solely a Chinese phenomenon. The robust performance in the US markets towards the end of the previous week also played a crucial role. A positive closing bell on Wall Street often sets the stage for a similar trend in Asian markets, as global investors react to the sentiment displayed by the world’s largest economy. This interconnectivity highlights the increasingly globalized nature of financial markets and the interconnectedness of different economies. A successful performance in one key market can often trigger a chain reaction, leading to positive sentiment spreading across the globe.

However, despite the significant gains, caution remains among investors. While the positive data is encouraging, it’s important to avoid premature conclusions. The recovery could be short-lived, and the underlying challenges facing the global economy haven’t entirely disappeared. Geopolitical uncertainties, inflation concerns, and potential interest rate hikes continue to loom large, casting a shadow over the long-term outlook.

The surge in Asian stock markets signifies a temporary reprieve, rather than a complete reversal of the recent downward trend. Investors are still assessing the broader economic landscape and the potential impact of ongoing global issues. This cautious optimism is reflected in the relatively moderate scale of the market gains, suggesting that investors are taking a measured approach rather than engaging in widespread speculation.

Furthermore, the strength of the recovery varied across different sectors and markets. While Chinese stocks benefited significantly from the strong PMI data, other Asian markets experienced more modest gains. This disparity highlights the nuanced nature of the recovery and suggests that sector-specific factors also played a significant role in shaping the market’s performance.

It’s crucial to remember that market fluctuations are a normal part of the economic cycle. The recent volatility and subsequent rebound serve as a reminder of the inherent risks associated with investing. Rather than panicking during market downturns or becoming overly optimistic during surges, a long-term, strategic investment approach is often the most prudent strategy. Staying informed about global economic trends and thoroughly researching investment options is essential for navigating the complexities of the financial markets. The recent Asian market surge provides a valuable case study, highlighting the importance of both economic indicators and global market sentiment in driving short-term market fluctuations. Investors should remain vigilant and continue to monitor the evolving economic situation to make well-informed decisions.

Leave a Reply