Nvidia: From AI Beneficiary to Future Uncertainty? A Shifting Market Landscape

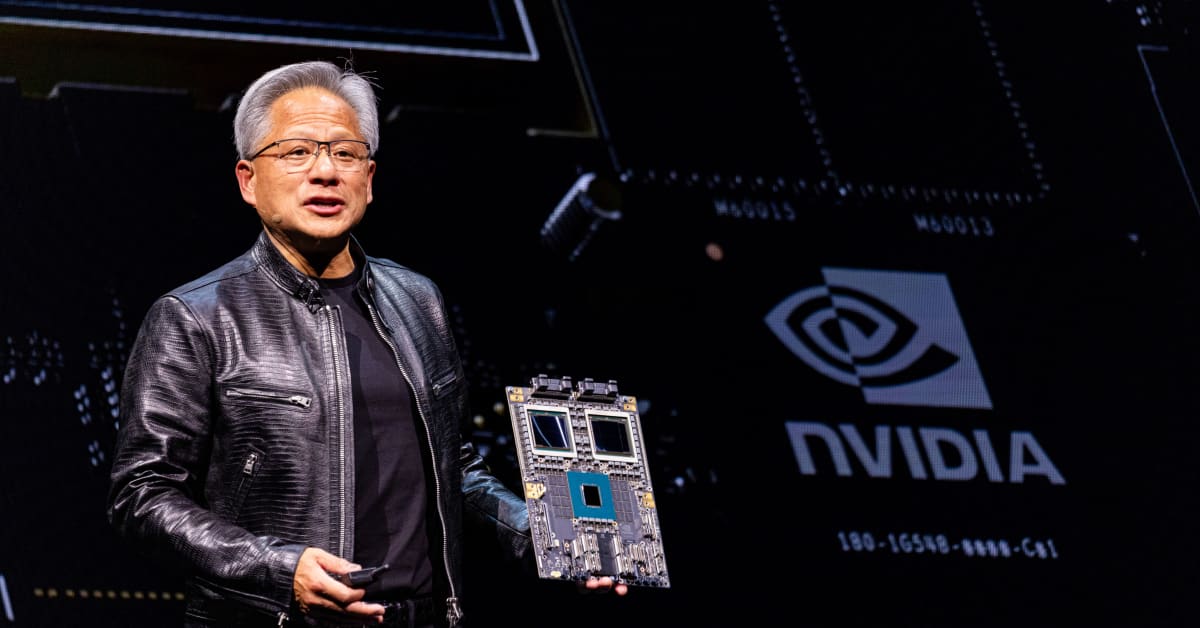

Nvidia’s meteoric rise is undeniable. The company, once primarily known for its graphics processing units (GPUs) in gaming, has become synonymous with the explosive growth of artificial intelligence. The surge in AI development, particularly the generative AI boom sparked by tools like ChatGPT, has catapulted Nvidia to the forefront of the tech world, driving its stock price to unprecedented heights. But as the dust settles on this initial AI frenzy, a seasoned Wall Street veteran is urging investors to recalibrate their expectations.

The initial surge was understandable. The demand for powerful GPUs capable of handling the immense computational demands of training large language models and other AI applications created a near-perfect storm. Nvidia, with its cutting-edge hardware and established market dominance, was perfectly positioned to capitalize on this unprecedented demand. The narrative was simple: AI is booming, Nvidia is essential to AI, therefore Nvidia’s stock will continue to climb.

However, this simplistic narrative may be overlooking crucial nuances in the rapidly evolving AI landscape. While the demand for high-performance computing remains strong, the sheer pace of growth may be unsustainable in the long term. The initial wave of investment in AI infrastructure, driven by excitement and the perceived need to quickly establish a presence in this burgeoning market, is starting to show signs of slowing.

This shift in the market doesn’t necessarily signal the beginning of a decline for Nvidia. Instead, it suggests a period of consolidation and perhaps a recalibration of expectations. The massive investments already made are likely to yield returns, ensuring continued demand for Nvidia’s products in the near future. However, the sheer magnitude of the previous growth may prove difficult, if not impossible, to replicate.

The future success of Nvidia will likely hinge on its ability to adapt and innovate. The company needs to continue pushing the boundaries of GPU technology, ensuring that its hardware remains at the cutting edge of AI development. This requires not only continuous R&D investment, but also strategic partnerships and acquisitions that allow for access to cutting-edge talent and complementary technologies.

Furthermore, Nvidia’s diversification strategy will play a crucial role in its long-term outlook. While AI remains a key driver of growth, over-reliance on a single sector carries inherent risks. The company’s efforts in other markets, such as autonomous vehicles and high-performance computing for scientific research, will be critical in mitigating these risks and ensuring a more stable and predictable revenue stream.

In conclusion, the initial euphoria surrounding Nvidia’s stock performance, fueled by the AI boom, is understandably giving way to a more measured assessment. The future is far from certain, and significant challenges lie ahead. However, Nvidia’s strong fundamentals, ongoing innovation, and diversified approach suggest a continued relevance in the rapidly evolving technological landscape. The company’s future success, however, will depend on its adaptability and ability to navigate the increasingly complex dynamics of the AI market. The days of hyper-growth may be behind us, but a strong, albeit more measured, future for Nvidia remains plausible.

Leave a Reply