Nvidia: Riding the AI Wave – But What’s Next?

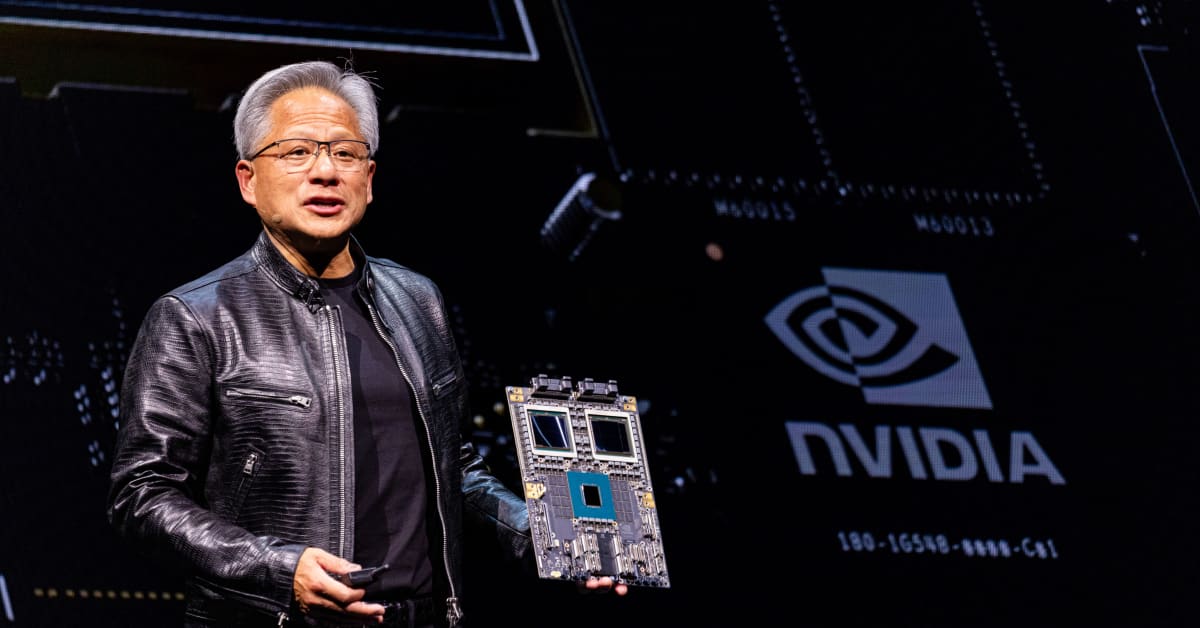

Nvidia’s meteoric rise is undeniable. The company, once largely known for its graphics processing units (GPUs) powering video games, has become a titan of the artificial intelligence (AI) revolution. The explosive growth in AI, fueled by the public’s fascination with generative AI tools like ChatGPT, has sent Nvidia’s stock soaring. This dramatic surge, however, prompts a crucial question: what’s next for this tech powerhouse?

The initial catalyst was clear: the insatiable demand for powerful computing capabilities to train and run sophisticated AI models. Nvidia’s GPUs, originally designed for rendering complex visuals, proved exceptionally well-suited for the computationally intensive tasks required for AI development. This happy coincidence placed Nvidia at the epicenter of a technological gold rush. Companies and researchers worldwide scrambled to acquire Nvidia’s hardware, driving unprecedented demand and pushing the stock price to record highs.

However, seasoned investors are always looking beyond the immediate hype. While the current AI boom is undeniable, sustained growth requires more than just a temporary surge in demand. The long-term prospects hinge on several key factors. One crucial aspect is the continued innovation within AI itself. Will the current pace of development continue? Will new, unforeseen applications emerge, driving further demand for high-performance computing? The answers to these questions will heavily influence Nvidia’s future trajectory.

Another significant factor is competition. While Nvidia currently dominates the market for high-end GPUs used in AI, the lucrative nature of this sector is attracting substantial investment from competitors. New entrants and established players are actively developing their own hardware and software solutions, aiming to challenge Nvidia’s dominance. The intensity of this competition will directly impact Nvidia’s market share and ultimately, its profitability.

Beyond the technological landscape, macroeconomic factors also play a significant role. The global economy’s health, interest rates, and overall investor sentiment can all influence investor decisions regarding Nvidia’s stock. A downturn in the broader economy could dampen investor enthusiasm, potentially leading to a correction in the stock price, even if the underlying technology remains strong.

Looking ahead, many analysts predict continued growth for Nvidia, but with a more nuanced perspective. The initial explosive growth might moderate as the market matures. The focus will shift from simply acquiring hardware to optimizing its use and developing more efficient AI algorithms. This transition could present new opportunities for Nvidia, potentially involving software and services alongside hardware.

In essence, Nvidia’s success story is a testament to the transformative power of AI and the company’s ability to capitalize on a burgeoning market. However, the future remains dynamic and uncertain. Sustained growth will require not only continued innovation within the AI field but also the ability to navigate an increasingly competitive landscape and adapt to evolving macroeconomic conditions. The coming years will be crucial in determining whether Nvidia can maintain its leading position and justify its current lofty valuation. The ride has been exhilarating, but the road ahead demands careful navigation.

Leave a Reply